Attain Lower Repayments: Crucial Insights on Lending Refinance Options

Financing refinancing offers a critical opportunity for property owners looking for to lower their regular monthly repayments and general economic obligations. By analyzing different refinance alternatives, such as rate-and-term and cash-out refinancing, individuals can tailor solutions that straighten with their particular monetary conditions.

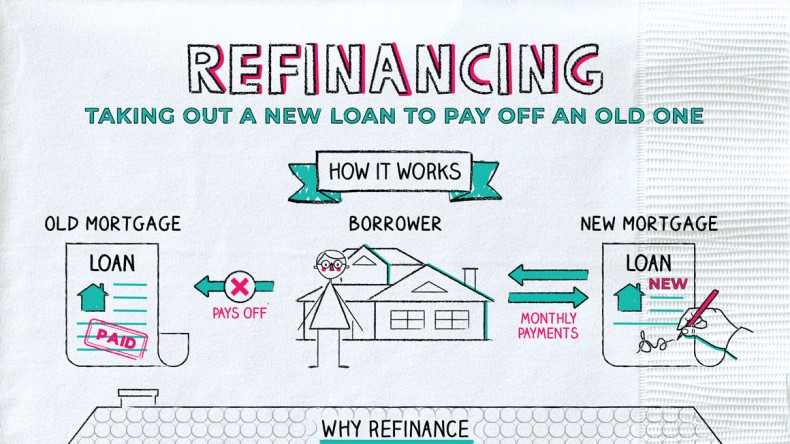

Recognizing Finance Refinancing

Financing refinancing is a financial approach that allows borrowers to change their existing financings with brand-new ones, typically to secure extra beneficial terms. This process can bring about lower passion rates, minimized monthly repayments, or a various finance duration that better straightens with the consumer's financial objectives.

The key inspiration behind refinancing is to improve financial adaptability. By evaluating present market conditions, customers may discover that rates of interest have actually reduced because their original car loan was taken out, which could lead to considerable cost savings gradually. Additionally, refinancing can offer chances to consolidate financial debt, transforming multiple high-interest obligations right into a solitary manageable payment.

It is important to take into consideration the associated prices of refinancing, such as closing costs and other costs, which can offset possible savings. Examining one's financial circumstance and long-term objectives is necessary before dedicating to refinancing.

Kinds Of Refinance Options

Refinancing deals numerous options tailored to fulfill varied financial needs and goals. One of the most typical kinds consist of rate-and-term refinancing, cash-out refinancing, and enhance refinancing.

Rate-and-term refinancing enables borrowers to readjust the rate of interest, lending term, or both, which can lead to reduce regular monthly payments or reduced total rate of interest expenses. This alternative is frequently gone after when market prices go down, making it an enticing option for those aiming to save on interest.

Cash-out refinancing makes it possible for house owners to access the equity in their home by obtaining greater than the existing home mortgage balance. The distinction is taken as cash, giving funds for major costs such as home restorations or debt loan consolidation. Nonetheless, this choice increases the total lending amount and may affect long-lasting monetary security.

Each of these refinancing kinds supplies distinct benefits and factors to consider, making it necessary for consumers to examine their specific financial situations and objectives before proceeding.

Advantages of Refinancing

Just how can house owners gain from re-financing their mortgages? Refinancing can supply several economic advantages, making it an eye-catching option for many (USDA loan refinance). One of the most significant advantages is the possibility for reduced rate of interest prices. If market prices have reduced since the original mortgage was secured, property owners may refinance to acquire a lower rate, which can result in decreased month-to-month repayments and considerable savings over the financing's term.

Additionally, refinancing can help property owners access equity in their property. By going with a cash-out reference refinance, they can transform a portion of their home equity right into cash, which can be used for home enhancements, financial debt consolidation, or other monetary requirements.

One more benefit is the possibility to alter the finance terms. Homeowners can change from an adjustable-rate home mortgage (ARM) to a fixed-rate mortgage for greater security, or reduce the car loan term to pay off the home mortgage much faster and reduce passion costs.

Aspects to Take Into Consideration

Prior to making a decision to re-finance a home mortgage, property owners ought to meticulously assess a number of essential variables that can significantly affect their monetary circumstance. First, the present rate of interest out there need to be examined; refinancing is generally useful when prices are less than the existing home loan rate. In addition, it is necessary to consider the remaining regard to the current home mortgage, as prolonging the term can cause paying even more passion gradually, regardless of reduced monthly payments.

Lastly, homeowners ought to assess their lasting monetary goals. If intending to relocate the future, refinancing might not be the most effective alternative (USDA loan refinance). By carefully taking into consideration these factors, homeowners can make educated choices that align with their financial objectives and total security

Steps to Re-finance Your Funding

As soon as home owners have actually reviewed the essential variables influencing their decision to refinance, they can continue with the essential steps to finish the process. The initial step is to determine the kind of re-finance that finest matches their monetary objectives, whether it be a rate-and-term refinance or a cash-out refinance.

Next, homeowners must collect all appropriate monetary files, including revenue declarations, income tax return, and information concerning existing financial obligations. This paperwork will be important when requesting a new lending.

When an ideal lender is picked, home owners can send their application. The lending institution will certainly carry out a comprehensive review, which may include an assessment of the home.

After approval, home owners will get a Closing Disclosure outlining the terms of the brand-new lending. Upon closing, the brand-new lending will certainly pay off the existing home loan, and property owners can begin enjoying the benefits of their refinanced funding, including lower regular monthly settlements or accessibility to money.

Conclusion

In final thought, funding refinancing presents a valuable opportunity for property owners to achieve lower repayments and minimize economic stress. By recognizing various re-finance options, such as rate-and-term, cash-out, and enhance refinancing, people can make informed choices tailored to their monetary circumstances. Mindful factor to Get More Info consider of market conditions and loan provider comparisons better enhances the possibility for lasting financial savings. Ultimately, critical refinancing can substantially improve financial security and supply greater flexibility in handling costs.